Justin Volz/for ProPublica

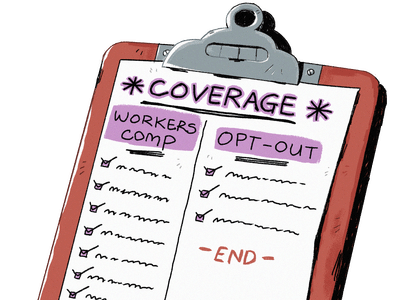

On October 14, 2015, NPR and ProPublica published the next installment of its series focused on issues plaguing workers’ compensation in America, “Opt-Out Plans Let Companies Work Without Workers’ Comp.” The article examines a recent trend in Texas and Oklahoma that threatens to expand: workers’ compensation is shifting from state-mandated benefits to largely unregulated ones controlled by employers.

Rachel Jenkins was working as a job coach and personal care aide for mentally disabled adults last March when she hurt her shoulder stopping a brawl between two clients. She was treated at a local hospital and the pain medication she received made her extremely tired and groggy. She reported her injury 27 hours after her shift, but that was too late for her employer. Under the company’s plan, injuries must be reported within 24 hours, rather than the typical 30 days under state law.

After Jenkins’ supervisor went to bat for her, the hospital’s insurance carrier agreed to cover the medical bills and lost wages. From the carrier’s point of view, the system had worked – but after worrying for over two weeks about how she and her four children were going to get by, that’s not how Jenkins sees it.

“I went through hell, a whole lot of pain where I was in tears,” Jenkins said. “I was just thinking … ‘How am I going to take care of my kids?’ “

Growing numbers of workers in Texas and Oklahoma are finding themselves in the horrific situation of being hurt at work and having to navigate confusing and meager employer workplace injury plans. These unregulated plans frequently cover fewer injuries, cut off benefits for injured workers sooner and impose mandatory settlements that rarely cover injured workers’ losses. Rules about reporting injuries and limitations on compensation can leave injured workers deprived of the benefits they need to put their lives back together.

These employer workplace injury plans are a chilling reminder of a larger trend happening in America – the crumbling of workers’ compensation. Workers’ comp was designed to be a safety net for workers in case they are hurt on the job. In exchange for guaranteed wage loss benefits and medical coverage, workers gave up a constitutional right to sue their employers. Control of the program, originally meant to favor injured workers, has been shifting toward employers. If employers and insurance carriers are controlling how benefits are distributed to injured employees, workers are likely to be unfairly represented.